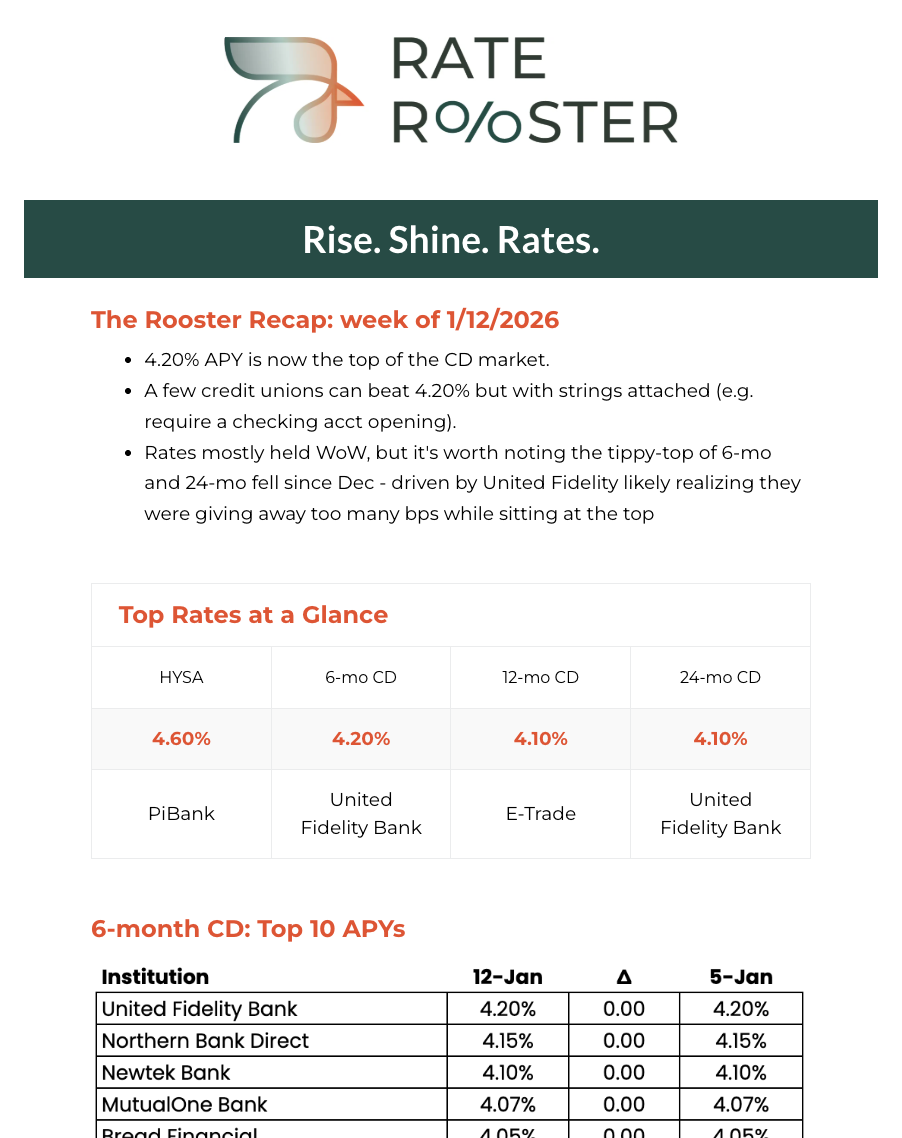

The RateRooster newsletter

Empowering banks with APY intelligence, delivered weekly.

Make more informed APY decisions

With the latest rates arriving in your inbox every week, you can benchmark your offering against the list of national and regional rates we track. This will help you pinpoint the right APY for every deposit product in your portfolio.

Manage your margins more easily

Every basis point matters. By seeing rate movement on a weekly basis, you can gauge if other institutions are shaving bps, which can signal you can, too.

Save time with curated, actionable information

Instead of sorting through endless sources of datasets, receive all the crucial CD rate info you need in one concise, easy-to-read update. Focus on rate decisions, not rate gathering.

What we track

Certificates of Deposit

6-month

9-month

12-month

18-month

24-month

Savings Accounts

We track the High Yield variety. Not so much the Money Market accounts.

Treasury Yield

We list the yield as of the day our weekly rates are gathered. It's a snapshot to give you a sense, not a daily, real-time monitor.

Who we track

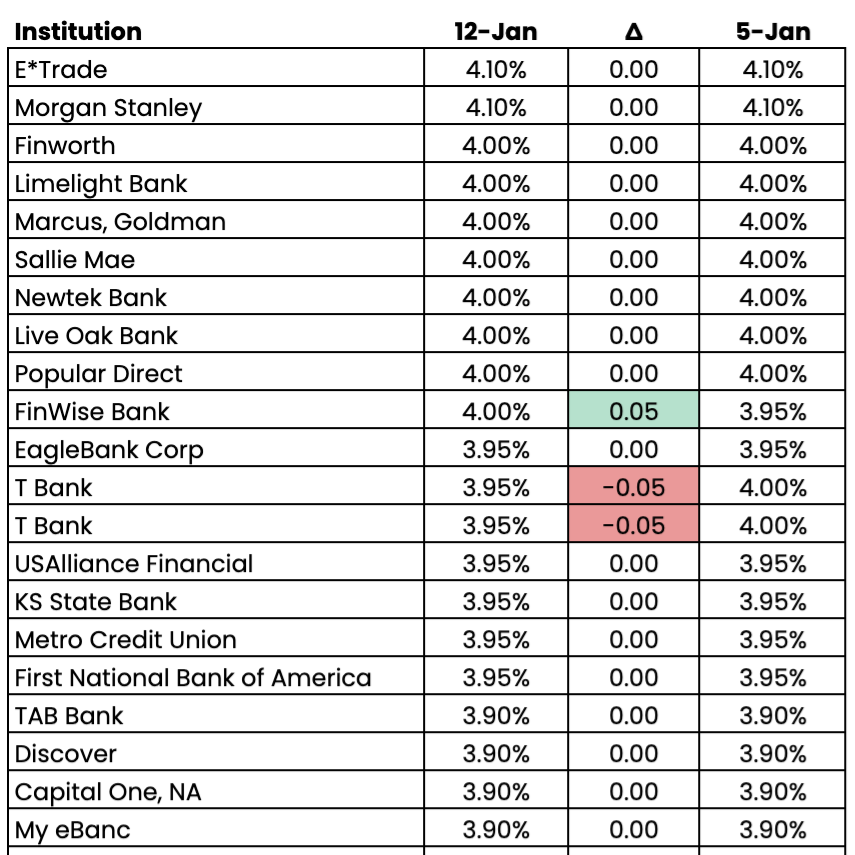

Banks. And lots of them. We have what we consider our master list of banks we track. The list was formed to represent a range of bank sizes and types.

We pull in most of the big banks given their national reach, but we also include what we consider well known banks ("well known" is subjective but this group tends to be the banks most of us have heard of), online banks, regional players and even a few credit unions.

Banks can also be included if they post a great rate, but do not belong in our "master" list. Hey. A great rate is a great rate.